Forget ‘Uptober’, its REKTOBER : BTC Price Set to CRASH Below $100k

While investors are becoming euphoric due to the perceived strong start to what everybody is calling ‘Uptober’, several warning signs are emerging that point toward a market-wide crash, which could see BTC price fall below $100k, dragging altcoins along with it.

The Bitcoin 1-day chart is flashing a bearish signal, while the US Government has just gone into shutdown. Meanwhile, there is a strong consensus online among traders calling for new crypto highs in October and throughout Q4. Whenever the majority of investors are aligned on the direction of the market, historically, the opposite tends to happen.

Today, the global cryptocurrency market cap is $4.18T, up 1.9% in the last 24 hours, with

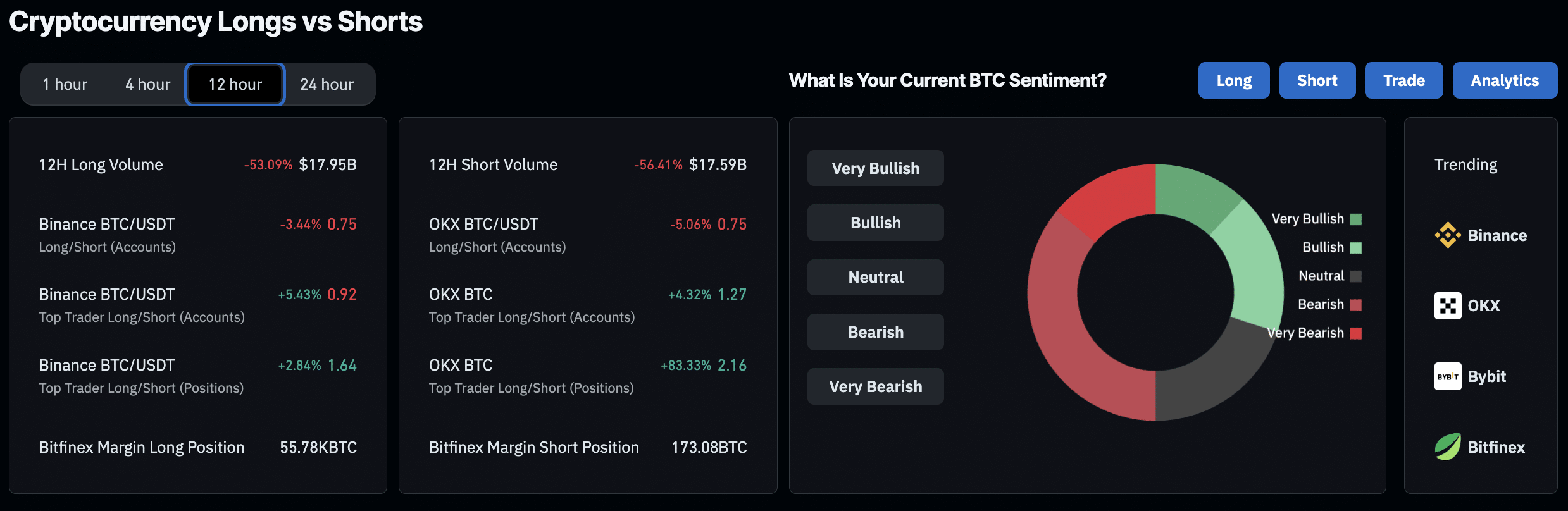

trading at around $118,700. As the market becomes more euphoric, traders are building longs, which could quickly result in a long squeeze if BTC rejects at $120,000 or before.

(SOURCE: CoinGlass)

Global Economic Challenges Bearish for Crypto

Just a heads up: past performance doesn’t really mean much for the future, especially if the market’s taken some crazy turns. We are currently facing some significant macroeconomic challenges. If inflation persists or starts to creep up again, the Fed might hold onto those high interest rates for a while or even raise them further.

Bitcoin and other cryptos are starting to be seen as risk-on assets, which is excellent news when interest rates are low. However, when traditional markets hit a rough patch and interest rates are high, these speculative assets usually take a hit. Plus, the way crypto tends to run with tech stocks suggests that when the market drops, crypto probably won’t hold up too well either.

Regulatory stuff is still sketchy. We’ve seen some clarity, but ongoing enforcement actions and the possibility of new rules could still deter institutional interest. The buzz about upcoming altcoin spot ETFs might already be priced in when factoring in the classic “buy the rumor, sell the news” playbook.

And let’s not forget about liquidity. This could become tricky if we see some deleveraging in crypto markets or if stablecoin supply drops, as that reduces buying power across the board.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Government Shutdown Could be a Black Swan Event in the Making

Senate Democrats just voted to send the government into a shutdown. DEMOCRAT SHUTDOWN LOADING. pic.twitter.com/t7I2x7guxZ

— The White House (@WhiteHouse) September 30, 2025

Yesterday (October 1), the US Government went into a complete shutdown, which means agencies like the SEC and CFTC operate with skeleton crews and pause non-essential functions, which could in turn hurt the BTC price.

This tends to create a vacuum, resulting in unclear regulatory decisions, which increases the likelihood of stalled progress on crypto legislation and a lack of guidance for institutions looking to enter the space.

Markets tend to react negatively to uncertainty, and this ambiguity may lead institutional investors to delay or reduce their cryptocurrency allocations until more stable conditions arise.

If a government shutdown impacts regulatory oversight or operational elements of financial markets, it could hinder inflows into Bitcoin and Ethereum ETFs or the approval of new cryptocurrency products.

SOL, XRP, LTC, and

were all slated to be close to receiving approval for their various spot ETF applications. Still, the shutdown could delay this, which would be another bearish catalyst for the broader crypto market.

Another potential fallout from the shutdown is this month’s Federal Reserve FOMC meeting. It is expected that the Fed will cut interest rates by another 25bps following September’s cut. However, the Government’s uncertainty could lead to a delay in the decision, or the worst-case scenario is that Powell announces no changes to interest rates.

DISCOVER: 20+ Next Crypto to Explode in 2025

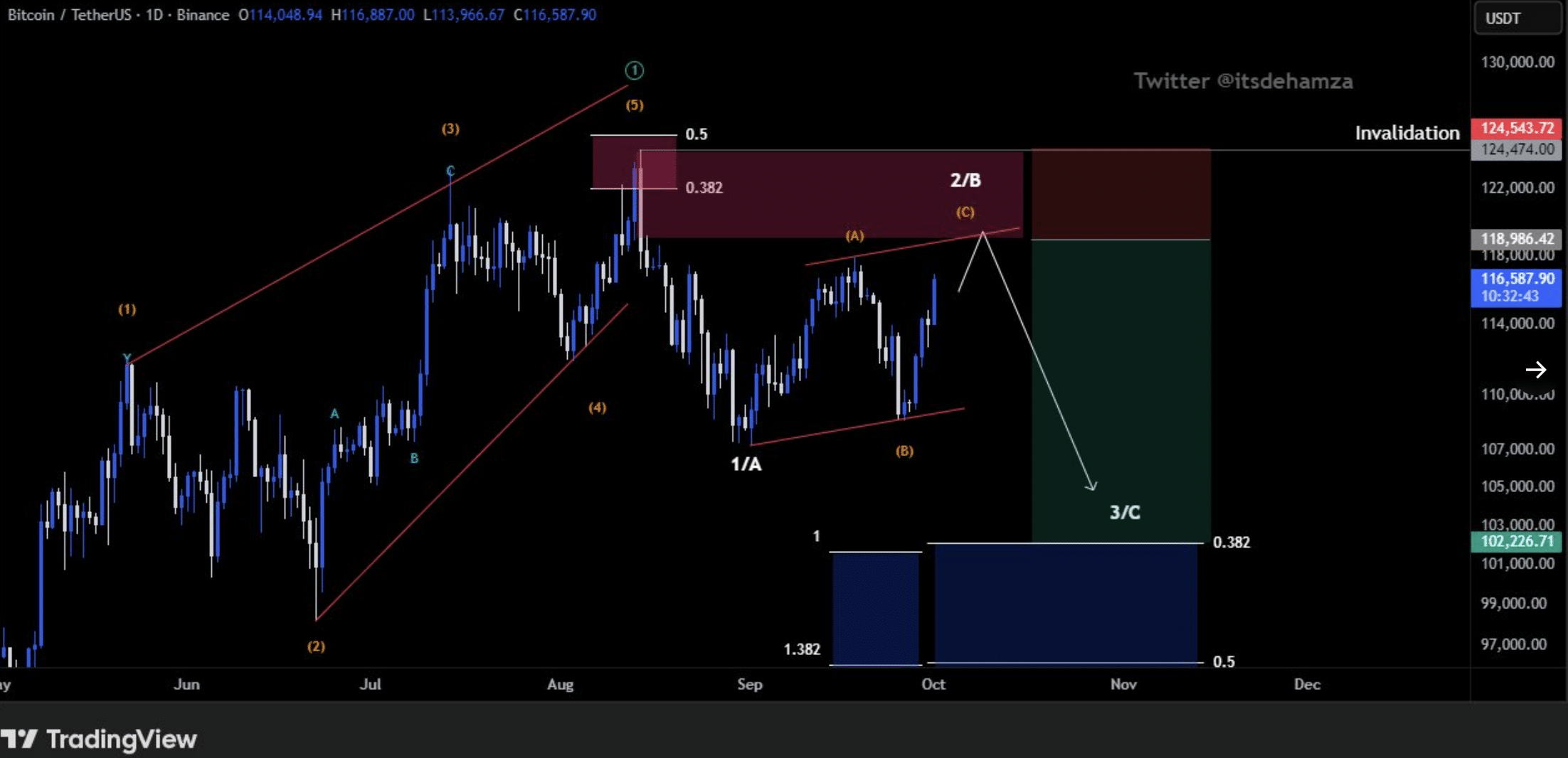

Wave Pattern Showing $119K Then Sub $100K

When overlaying Elliot Wave theory to the Bitcoin 1-day chart, we can observe this structure as a big zigzag in wave 2/B. Major supply zone begins at around $119K, which is where we can expect the next big sell impulse to start.

Worryingly, BTC price is trading just a few hundred dollars below the $119,000 level, meaning a significant move could be coming sooner rather than later. It would be impeccable timing as investors are quickly becoming euphoric, flashing green P&L cards and calling for wild price targets on their favourite tokens.

If Bitcoin indeed rejects between $119,000 and $120,000, there is a strong likelihood that it will fall below $100,000. This bearish setup will be invalidated if the BTC price closes the day above $124,500.

Crypto Fear and Greed Chart

Another metric to consider when speculating about the market’s direction in October and beyond is the classic Fear & Greed index. After reaching 44 last week, firmly within the ‘fear’ category, today it stands at 64, which equates to the market feeling ‘greed’.

When used in conjunction with technical analysis and other indicators, the Fear and Greed Index has historically been an accurate indicator of crypto price speculation. Warren Buffett said it best: “Be fearful when others are greedy and be greedy when others are fearful.”

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Forget ‘Uptober’, its REKTOBER : BTC Price Set to CRASH Below $100k appeared first on 99Bitcoins.