BTC and ETH Price Recover: CPI Predictions and Why is the US Market Closed Today?

Breaking news: President Trump announces Columbus Day is BACK! So if you’re asking, “Why is the US market closed today?” that’s why.

“We’re calling it COLUMBUS DAY,” Trump said last week. *Entire room applauds*

We really need a higher bar for decorum in this country. Meanwhile, the crypto market just weathered one of its wildest 24-hour stretches of 2025. If you wonder why we are pumping right now, here is why:

On Friday,

plunged from $121,000 to $109,000 in just seven hours, part of a liquidation wave that erased nearly $20 Bn in leveraged positions.

Here’s what to expect from the market from here and the latest US economic data this week that could affect things. Stay tuned to the end for an exclusive Columbus Day gift from 99Bitcoins…

Why is the US Market Closed Today? CPI Predictions and McChickens

If you held a McChicken from 2020, you outperformed the S&P 500. As the saying goes, “Back in my day, McChickens used to be $1″… and that was only five years ago.

Inflation is ramping up again and although Washington, DC is entering week two of a shutdown, the Bureau of Labor Statistics will resume work on September’s Consumer Price Index, the nation’s leading inflation gauge.

BREAKING: The U.S. CPI report, initially scheduled for October 15, has been postponed to October 24 amid the ongoing government shutdown. pic.twitter.com/xJzu4Kt77X

— Conor Kenny (@conorfkenny) October 12, 2025

The report, now due October 24, comes nine days late, a small miracle amid the government shutdown that’s frozen nearly all economic data. Lawmakers have failed seven times to reopen the government, leaving most reports in limbo. But with cost-of-living adjustments on the line, the White House quietly ordered this one back online.

DISCOVER: Top 20 Crypto to Buy in 2025

Tariffs and Liquidations: Will Crypto Volatility Outpace Stocks?

Crypto Fear and Greed Chart

In total, $16.7 Bn of the $20 Bn in liquidations came from over-leveraged long positions. Nearly $7 Bn was wiped out in a single hour, with one analyst describing it as a “flash crash of liquidations.”

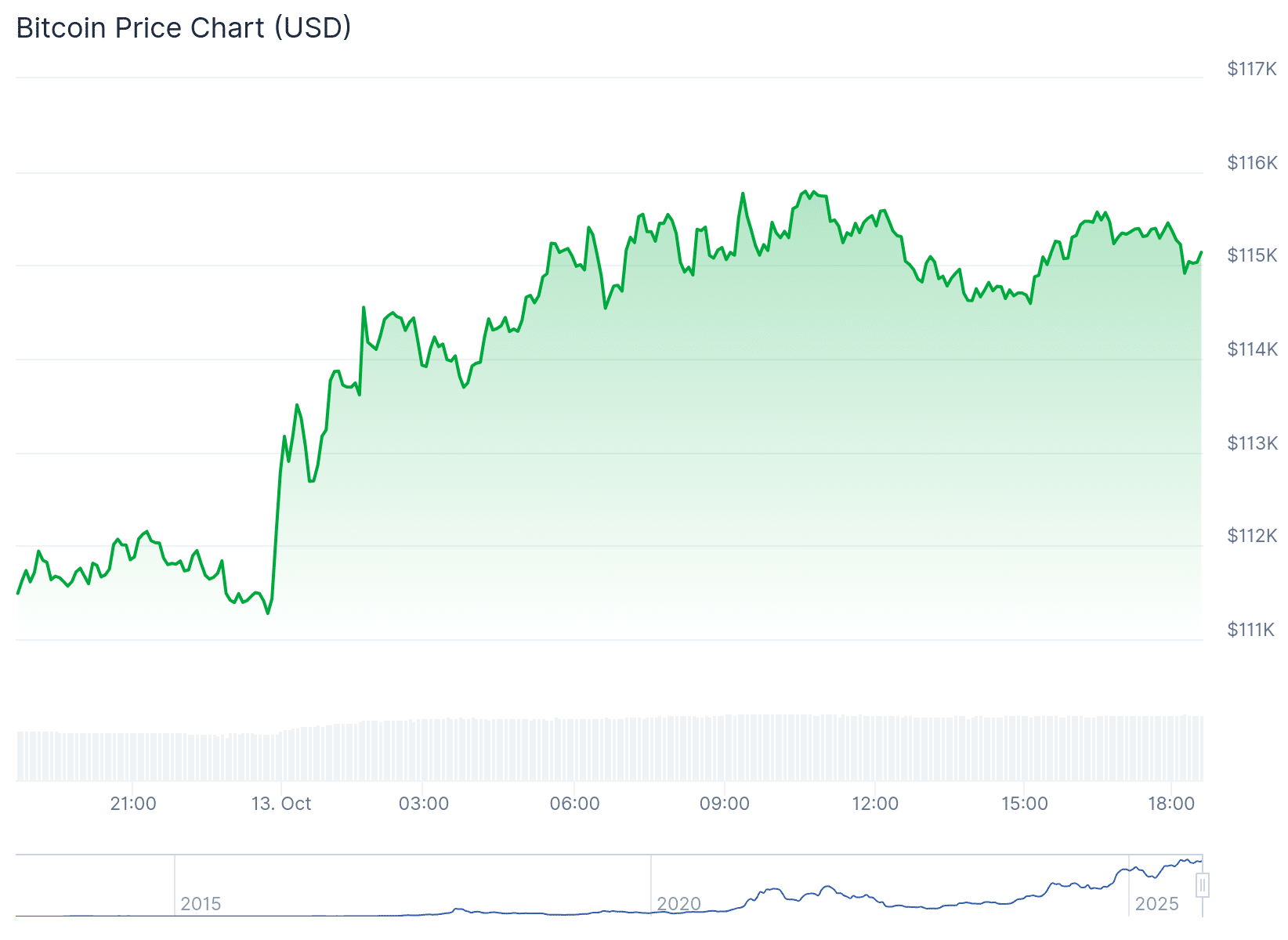

According to CoinGecko, Bitcoin is now trading around $115,500, down about 9% from last week’s highs but up +5% in the last 24 hours. Ethereum has rebounded to $4,138, and Solana sits near $196, both posting double-digit weekend gains.

Meanwhile, smaller tokens are staging massive comebacks: Synthetix (SNX) briefly jumped 100% to a new yearly high, while Mantle (MNT) and Bittensor (TAO) each rallied over 30%. DeFi markets remain resilient, with DeFi Llama reporting total value locked (TVL) holding above $157 billion, suggesting that long-term capital is staying put despite short-term chaos.

Samson Mow, founder of Jan3, added: “It’s time for Bitcoin’s next leg up.”

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Will Institutional Buyers Jump In on the Dip? (Our Columbus Day Gift)

Michael Saylor’s Strategy hinted it bought more Bitcoin, posting “Don’t Stop ₿elievin’” on X alongside the company’s growing BTC balance sheet. Analysts now see the correction as a reset, not a reversal, into a prolonged bear market.

Bitcoin’s next test is clear: hold above $115,000 and retake $120,000 before November. If it does, the path toward $150,000–$200,000 by year-end remains intact.

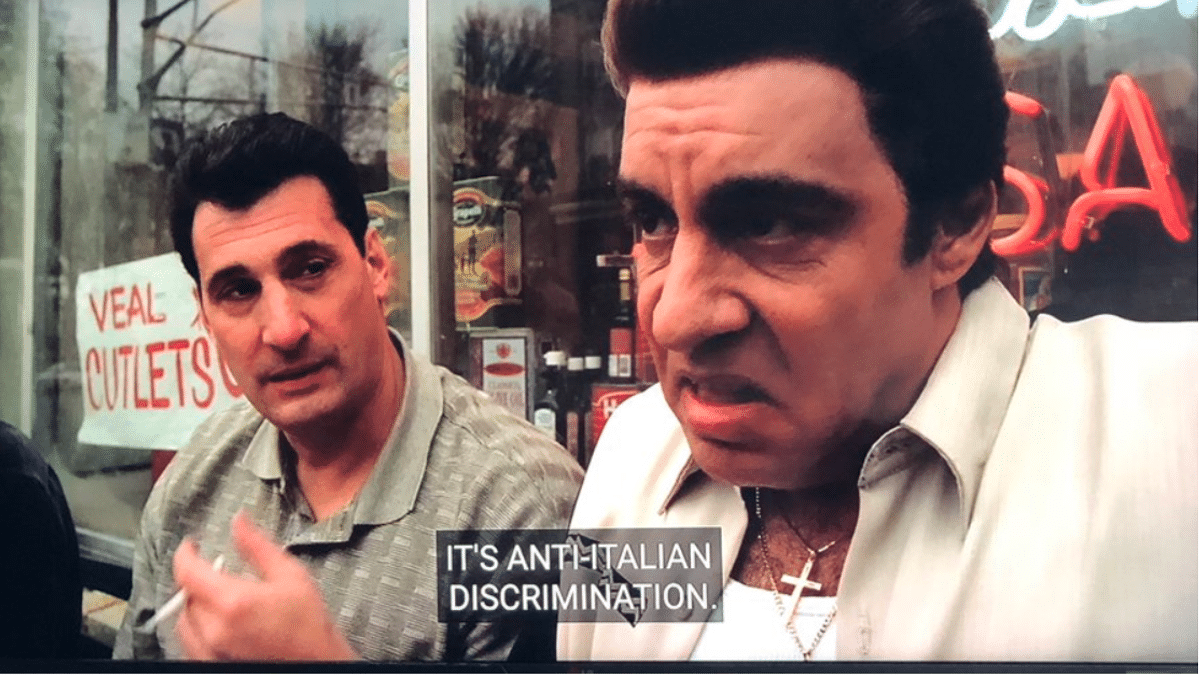

Okay … are you ready? Your Columbas Day gift from us at 99Bitcoins – one of the best memes ever from one of the best shows ever, The Wire. You’re welcome.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Breaking news: President Trump announces Columbus Day is BACK!

- If you held a McChicken from 2020, you outperformed the S&P 500.

The post BTC and ETH Price Recover: CPI Predictions and Why is the US Market Closed Today? appeared first on 99Bitcoins.