Chart Whisperer Says XRP Shows A ‘Purer’ Market Structure – Details

Veteran chartist Peter Brandt has shifted his view on XRP, moving from a short-lived bearish stance to a more positive outlook as the token tries to recover from a sharp market drop.

According to recent reports, XRP fell to $1.55 Friday, Oct. 10 during the sell-off, then bounced back into the mid-$2 range as traders reassessed the situation.

Brandt Revises Technical Take

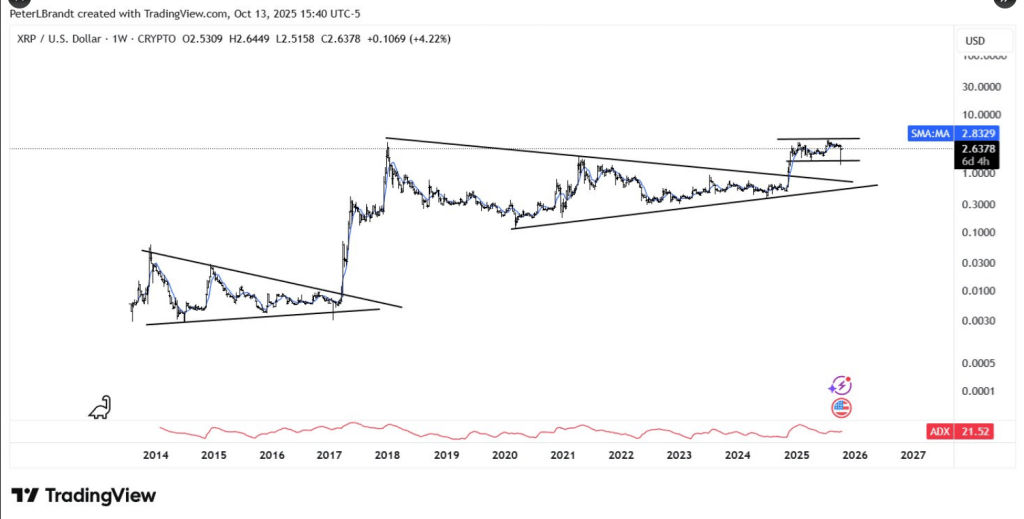

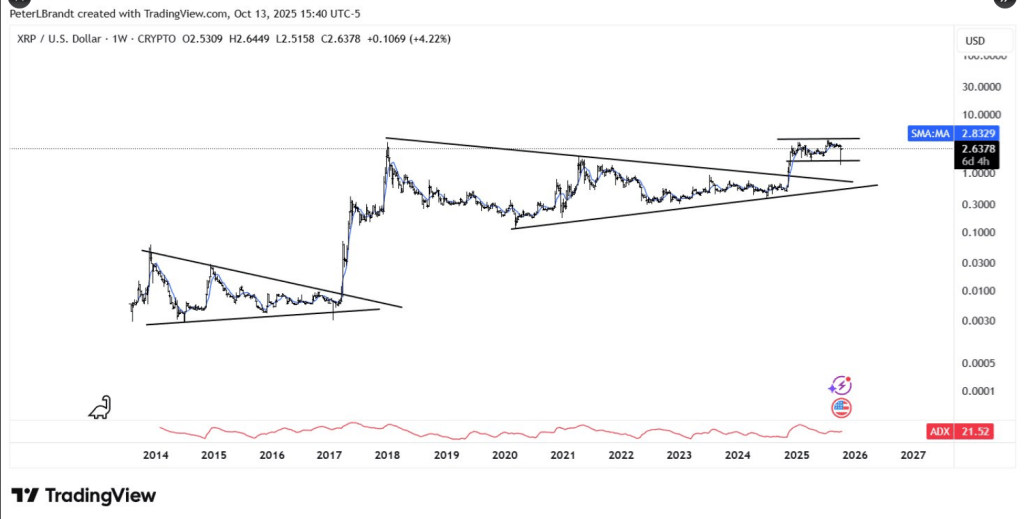

Brandt shared a long-term weekly chart covering 2013 to 2025. The chart shows years of sideways action that formed large triangle shapes before big moves.

Between 2014 and 2017, XRP was held inside a symmetrical triangle and then broke out in March 2017, which preceded a run up to $3.30 by January 2018.

That historical backdrop is being used now as a roadmap by some traders who see patterns repeating. Brandt’s recent update came after he had earlier listed XRP among possible short targets; he later said he closed his short for a profit and has since turned bullish.

As a student of classical charting principles and history, has there ever been a purer long-term chart? $XRP pic.twitter.com/rbA2Mp955A

— Peter Brandt (@PeterLBrandt) October 13, 2025

Channel Pattern After The Breakout

Data shows a break above the triangle took place during the November 2024 rally. After that move, XRP entered a parallel channel where prices moved back and forth.

The crash around Oct. 10 pushed XRP down to test the lower line of that channel, and the rebound has been built off that same support.

At one point Brandt had XRP trading near $2.64, under its one-week simple moving average of $2.83, and it has been reported to have corrected further to about $2.55 at press time.

Market strength is still thin; the Average Directional Index sits at 21.5, which points to a trend that is forming but not yet strong.

On-Chain Signal Shows Traders Selling At A Loss

Based on reports from Xaif Crypto, the Spent Output Profit Ratio (SOPR) for XRP dropped to a level last seen six months ago. That drop indicates many holders sold at a loss during the crash.

#XRP SOPR just dropped to 0.95 lowest in 6 months!

Last time SOPR hit 0.92 (Apr 7), XRP bounced +35% from $1.90 → $2.58.

Now with a low near $2.38, next potential target: $3.10–$3.35 pic.twitter.com/LVj3lINXpa— Xaif Crypto

|

(@Xaif_Crypto) October 13, 2025

Market watchers say a fall in SOPR can mark capitulation and sometimes precedes a recovery if buyers step in. During the sell-off, XRP slid nearly 44% from $2.8 to roughly $1.58, according to trading data, but it has since climbed back toward the $2.5 region as sellers have been absorbed.

Key Levels To Watch

A weekly close above $3 would be seen as proof of renewed strength. Resistance around $3.6 lines up with a July 2025 peak and could stall gains.

Support is marked by the breakout zone and a rising trendline that runs from about $0.8 to $1.5. If those supports break, XRP could move lower toward the $1 area before stabilizing.

Featured image from Pexels, chart from TradingView