Bitcoin BTC USD Price Bounces as Tariff Fears Fade But Inflation Looms

How the Bitcoin price moves determines the pulse of the crypto market. As the week comes to a close, the BTC USD price has been all over the place. Technically, buyers have a chance. However, given the recent state of price action, optimistic bulls hoping for a moon swing above $100,000 must prove themselves.

As it stands, the path of least resistance is southwards. Despite confidence and even the recent bounce of the Bitcoin price to the $90,000 level after the dip below $88,000 earlier this week, a conclusive, high-volume close above $95,000 could get the market moving.

Presently, traders expect prices to tick higher. If Bitcoin bulls build on recent wins, extending gains from January 21, a close above $92,000 could set the ball rolling for even more gains above local resistance levels. In that event, not only will improving crypto sentiment draw in more capital, but it will also ease recent fears tied to Trump’s tariff threats.

Crypto Fear and Greed Chart

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2026

Will Tariff Threats Fade and Lift The Bitcoin Price?

Yesterday, everyone expected Trump to issue more threats and even scare the EU with military action. However, he didn’t, and this, from a neutral’s perspective, is a welcome de-escalation of the current geopolitical crisis pitting Denmark, the EU, and the US.

Trump reignited his ambition to acquire Greenland earlier this week, calling it a vital “national security necessity.” When Denmark and eight European allies, including the UK, Germany, and France, rejected the proposal, the administration announced a tiered tariff structure. Trump said, beginning February 1, France, Germany, the UK, and five other EU countries will have to pay an extra +10% tariff on all imports. What’s worse? If a “total purchase deal” for Greenland was not reached by June 1, tariffs will increase to +25%.

As expected, when these threats were made, tech stocks took a hit. Prospects of paying a +10% tariff, let alone +25%, sent stock prices of leading European giants down, dragging the Nasdaq with it. While often seen as digital gold, Bitcoin still trades with high correlation to tech liquidity. As investors pulled money out of equities to seek safety in gold, which soared to all-time highs, above $4,800 this week, the BTC USD price sold off as part of general deleveraging.

#Gold continues its breakout pattern sequence.

Each major rally began after clearing a key resistance line — latest breakout targeting new highs.

Structure suggests another strong leg higher as momentum builds. pic.twitter.com/MBw87PgIWr

— Gold Predictors (@GoldPredictors) January 22, 2026

Yesterday in Davos, however, the tide turned. After a high-stakes meeting with Mark Rutte, the NATO Secretary-General, Trump announced a “framework for a future deal.” As part of this agreement, the February 1st tariff deadline has been scrapped. What’s more? Trump explicitly stated the US would not use “excessive strength or force” to acquire the territory, easing fears of a NATO fracture. The new framework shifts the conversation from “purchasing land” to “joint Arctic security,” which markets view as a manageable diplomatic process rather than an economic war.

In response to this, the Bitcoin price strengthened, recovering to the $90,000 level before slipping to spot rates.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2026

Eyes on Inflation

Whether the digital gold ticks higher in the coming weeks will lie mostly on institutions and macroeconomic developments. Although the “toning down of trade war fears led to a relief rally, inflation data will shape price action, not just of Bitcoin, but also of the next cryptos to explode.

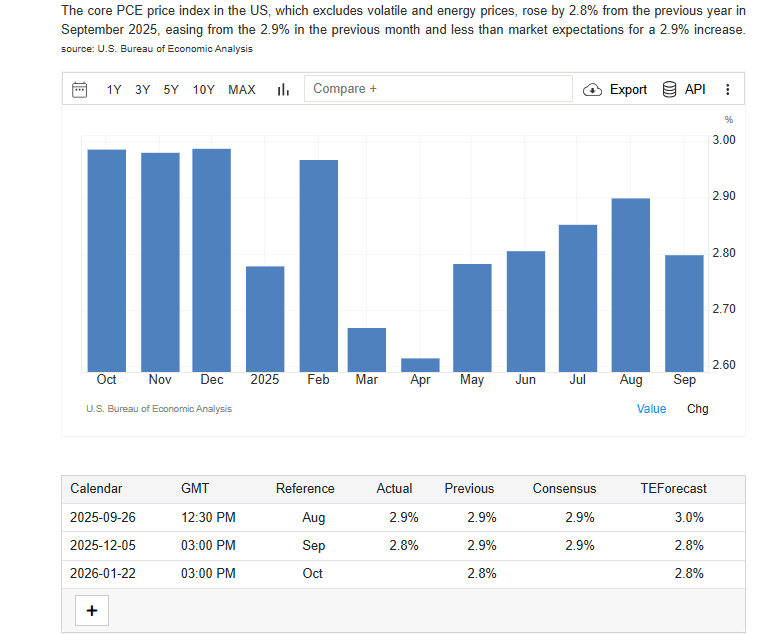

The Federal Reserve’s preferred inflation metric, the Core PCE, has remained stubbornly high throughout late 2025. Markets are currently bracing for a reading of roughly +2.7% YoY. The Fed’s target is +2.0%. A +2.7% reading confirms that inflation is “sticky”, meaning it isn’t falling fast enough to justify the aggressive rate cuts investors were hoping for in 2026. Even though the new tariffs were just paused, earlier trade restrictions from 2025 have already baked higher costs into the supply chain, keeping core prices elevated.

(Source: TradingEconomics)

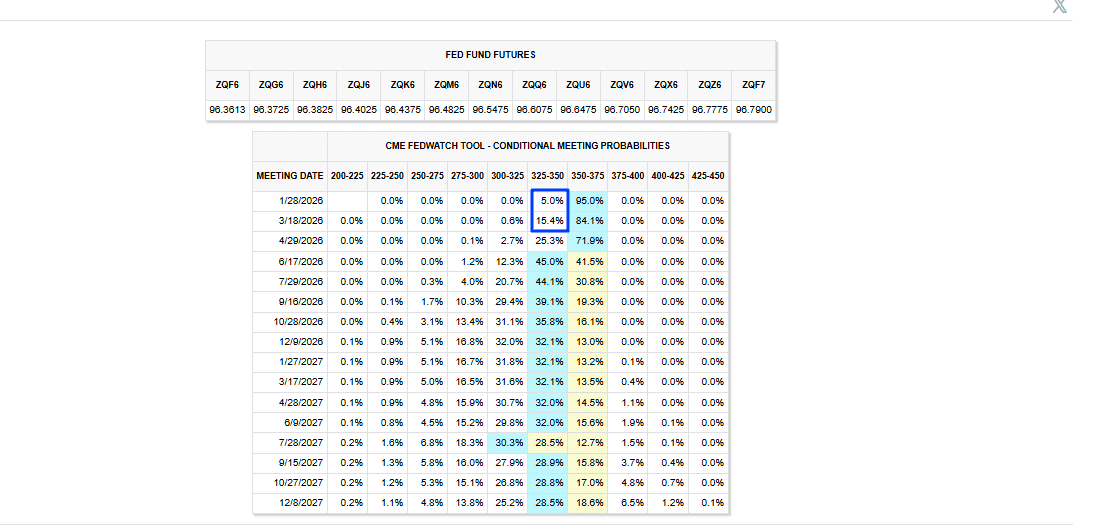

Usually, high inflation leads to “Hawkish” Fed policy, which sucks liquidity out of the market. As of late January 2026, there is less than a +20% probability of a rate cut in Q1 2026. If the PCE data is high, those odds could drop to zero, possibly triggering a re-pricing lower.

(Source: CME)

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Bitcoin BTC USD Price Bounces as Tariff Fears Fade But Inflation Looms appeared first on 99Bitcoins.