The $6B Bitcoin Gap: Why New Institutional Whales Now Move BTC

Bitcoin reportedly sits on a $6 billion pressure point as new institutional whales replace early holders as the main price drivers. BTC hovered near recent highs as volatility spiked, even without heavy retail trading. This fits a bigger trend where Wall Street money, not crypto natives, now sets the tone.

That shift changes how Bitcoin moves day to day. And it changes what patience means for regular investors.

Institutions did not enter quietly. They entered with size, structure, and rules.

DISCOVER: Top 20 Crypto to Buy in 2026

What Is the $6 Billion Gap in Bitcoin?

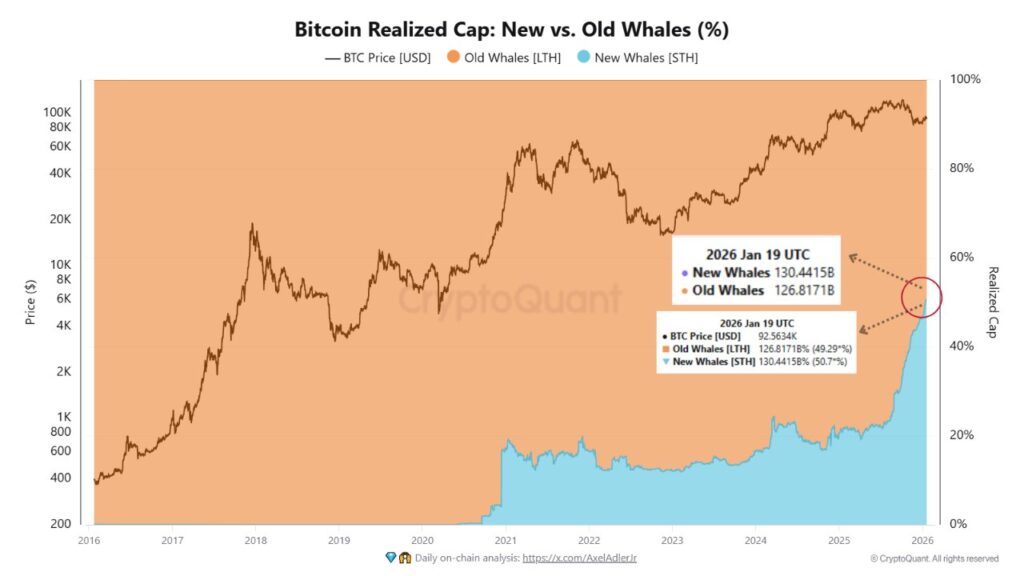

(Source: Realized Cap / X.com)

On-chain analysts track something called realized cap. Think of it like the total amount people actually paid for their Bitcoin, not today’s price tag. CryptoQuant data shows newer institutional buyers sit on about $6 billion in unrealized losses.

So what? These buyers paid higher prices than early whales. When BTC dips, they feel pain faster. That creates sharper reactions around key price levels.

Unlike early adopters who mined or bought BTC cheaply, institutions answer to boards and investors. That pressure matters.

Institutional Demand Is Now the Market’s Steering Wheel

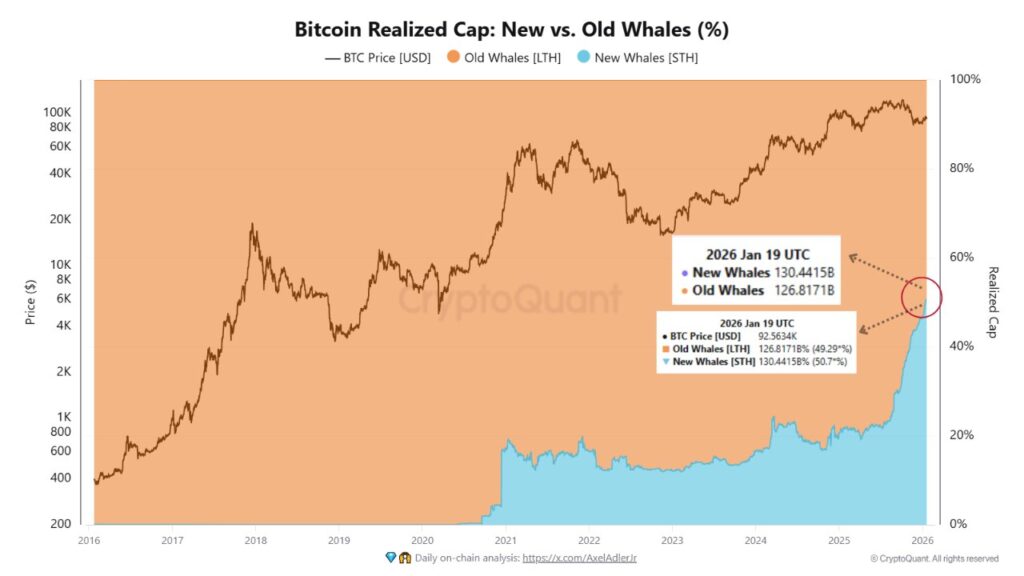

(Source: BTC ETF cumulative flows since the start of 2026 / Blockworks)

Public companies added roughly 131,000 BTC in Q2 2025 alone. That marked a 375% jump year over year.

At the same time, U.S. spot Bitcoin ETFs ballooned past $169 billion in assets. That equals nearly 7% of all Bitcoin supply. If you want context, see our breakdown of Bitcoin ETF inflows.

This matters because ETFs trade like stocks. Big inflows push BTC up. Big outflows pull it down. Fast.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

Why Price Swings Feel Different This Cycle

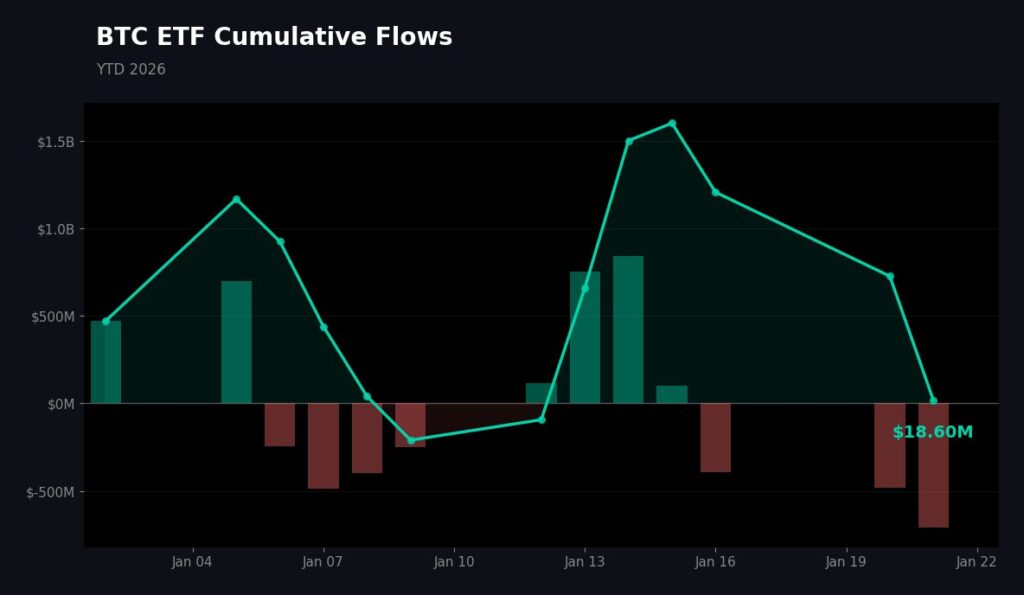

(Source: BTCUSD / TradingView)

Institutions helped drive BTC above $124,000 in mid‑2025 as ETF inflows hit $118 billion that quarter. When markets cooled, those same funds pulled hundreds of millions back out.

For beginners, here’s the plain-English takeaway. Bitcoin now reacts more like a macro asset. Rates, risk appetite, and fund flows matter more than Twitter hype.

That also means fewer wild pumps from small traders. Stability improves. Short-term swings still hurt.

Who Wins and Who Feels the Pain?

Long-term holders benefit from deeper liquidity and a clearer market structure. Institutions bring custody, compliance, and scale. Our coverage on institutional ETF inflows explains why banks like this setup.

Short-term traders face tighter ranges and sudden drops when funds rebalance. Retail no longer front-runs whales. Whales are the funds.

This is not good or bad. It is different.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post The $6B Bitcoin Gap: Why New Institutional Whales Now Move BTC appeared first on 99Bitcoins.