Crypto Market News Today, January 26: Bitcoin, Ethereum, XRP, and Crypto Price Gravitating as USD Falls

Bitcoin, Ethereum, and XRP, and most major crypto coins are dropping in price as the USD is taking a hit with rumors of Japanese Yen intervention and another US Government shutdown by the end of the month. Bitcoin dumped even more from last week to the 88,000 area, while Ethereum dumped by 1,4% and XRP fell further to the 2 USD mark.

People are speculating that the Fed could quietly follow Japan’s playbook and support the yen by selling dollars; the USD weakens by implication. What comes next usually follows with assets priced in dollars, these include Bitcoin, Ethereum, XRP, and most big crypto coins like Solana.

BREAKING:

As reported by the Financial Times, it appears that the NY Federal Reserve desk conducted rate check(s) on Friday in an effort to weaken the dollar/strengthen the Yen

This is incredibly rare, and signals that a LOT more dollar weakness might be ahead of us https://t.co/OgVz6B1bto pic.twitter.com/jeJOgl4o2H

— Milo (@milocredit) January 24, 2026

Bitcoin Price Falls as USD Weakens?

Bitcoin USD price is pinned under $88,000, testing support after a rough stretch of ETF outflows. US spot Bitcoin ETFs saw a healthy sum of outflows by the end of last week, and leverage liquidation hit $1.8 billion in liquidations over the past 2 days. As usual, institutional money does not tiptoe when it leaves.

Unexpectedly, GameStop transferred 4,710 Bitcoin, or about 422 million USD, to Coinbase Prime. Whether this will lead to a sale or a treasury reshuffle is still unclear, but it just doesn’t look good at all.

GameStop Moved 4.7K BTC to Coinbase Prime at $76M Loss

• GameStop, the world’s largest video game retailer, is seeing huge losses on its Bitcoin holdings as the leading asset struggles below $90,000.

• In May 2025, GameStop accumulated 4,710 BTC for roughly $504 million,… pic.twitter.com/R1yI24T6zy— D (@DateeD1) January 24, 2026

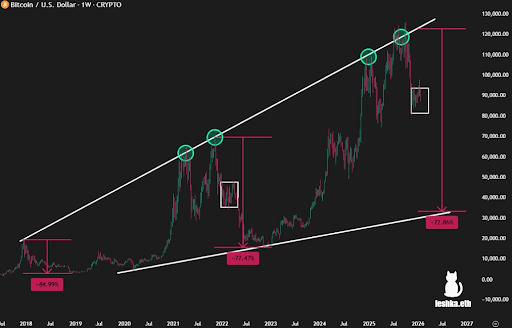

Price-wise, Bitcoin USD continues to echo older patterns seen against gold and even the NASDAQ. Gold just tagged $5,000 per ounce for the first time, silver crossed $100, and copper pushed to $5.92. Meanwhile, the total crypto market cap slid to a critical point of $3.04 trillion, erasing 150 billion in a short time span. However, historically, Bitcoin’s bear phases versus gold last around 14 months; the current drawdown sits near 51 percent over 350 days. Since the 2022 low, Bitcoin has tended to fall, go quiet for seven or eight weeks, then climb again. It is annoying, but time will tell.

DISCOVER: 10+ Next Crypto to 100X In 2026

Ethereum Price Slides, as ETH Foundation Spends 2 Million USD for Insurance

Ethereum price is holding support between 2,700 and 2,800 USD, with RSI hovering near oversold levels around 37. Bitcoin dominance remains high at under 60%, keeping altcoins on a short leash. Even so, Ethereum on-chain activity hasn’t cracked, as its price experienced a 10% dump this week.

Technically, ETH is consolidating below its 50-day EMA at $3,150 range, which caps upside for now. Still, oversold conditions often precede bounces toward 3,000, especially if Bitcoin USD stabilizes.

On the development side, the Ethereum Foundation launched a post-quantum security team with 2 million in funding, focusing on insurance and fondation, which is good for the years to comes.

Today marks an inflection in the Ethereum Foundation's long-term quantum strategy.

We've formed a new Post Quantum (PQ) team, led by the brilliant Thomas Coratger (@tcoratger). Joining him is Emile, one of the world-class talents behind leanVM. leanVM is the cryptographic…

— Justin Drake (@drakefjustin) January 23, 2026

XRP USD Rangebound as We Wait for Price Catalyst

The XRP price continues to respect a wide range that’s lasted nearly 400 days. The XRP USD price has oscillated between $1.8 and $3.6, a very wide 2x confusing range. Buyers who entered between $2 and $3 have endured drawdowns of 25 to 30 percent, and some suspect market makers could force a deeper flush before momentum backs, and are also very dependent on Bitcoin.

Macro forces loom large here, too. If the Fed does weaken the dollar by effectively creating dollars to buy Yen, USD devaluation could inflate risk assets across the board. In 2024, similar volatility preceded sharp BTC rallies, dragging the Ethereum and XRP price along for the ride.

It might be scary, but Big Four firm says crypto has crossed an irreversible point, and CZ Binance says the supercycle is coming this year.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

There are no live updates available yet. Please check back soon!

The post Crypto Market News Today, January 26: Bitcoin, Ethereum, XRP, and Crypto Price Gravitating as USD Falls appeared first on 99Bitcoins.