Hyperliquid Momentum Builds as HIP-3 Open Interest Hits $790M—Can HYPE Price Test $50 in February?

The post Hyperliquid Momentum Builds as HIP-3 Open Interest Hits $790M—Can HYPE Price Test $50 in February? appeared first on Coinpedia Fintech News

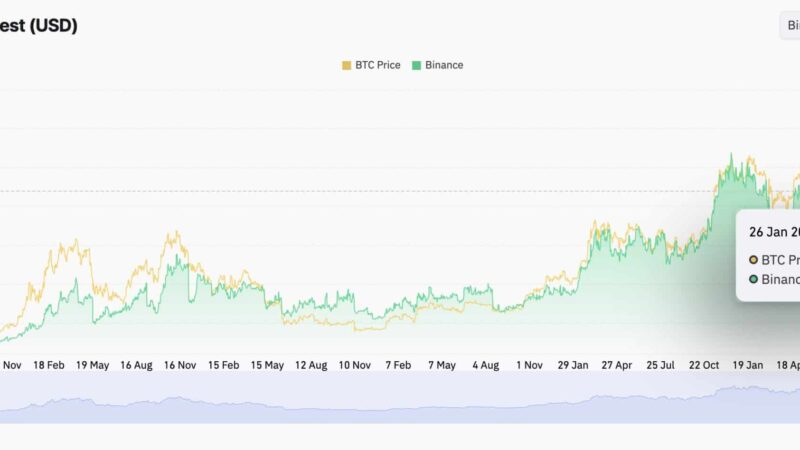

The liquidity rotation seems to have begun for the other altcoins as the top ones are consolidating within a tight range. After maintaining weeks of descending consolidation, the Hyperliquid (HYPE) price has triggered a massive upswing. This has induced huge confidence among the market participants, as volume has also surged by more than 100%. Along with Axie Infinity, which surged by more than 35%, HYPE’s price is believed to rise high if the bulls manage to break an important barrier.

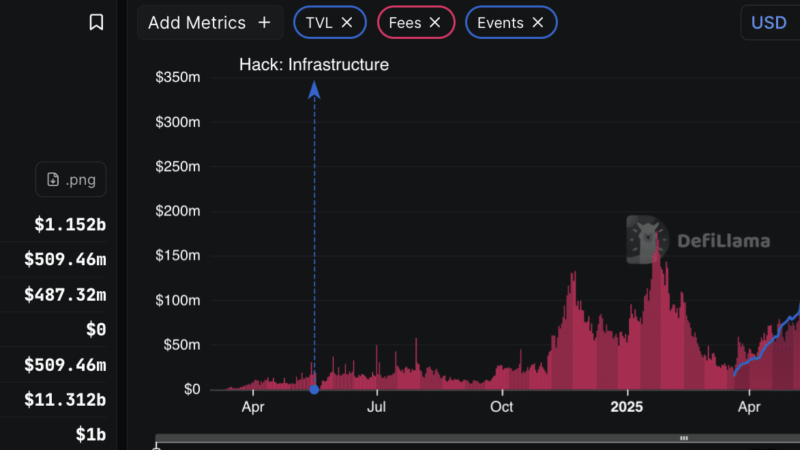

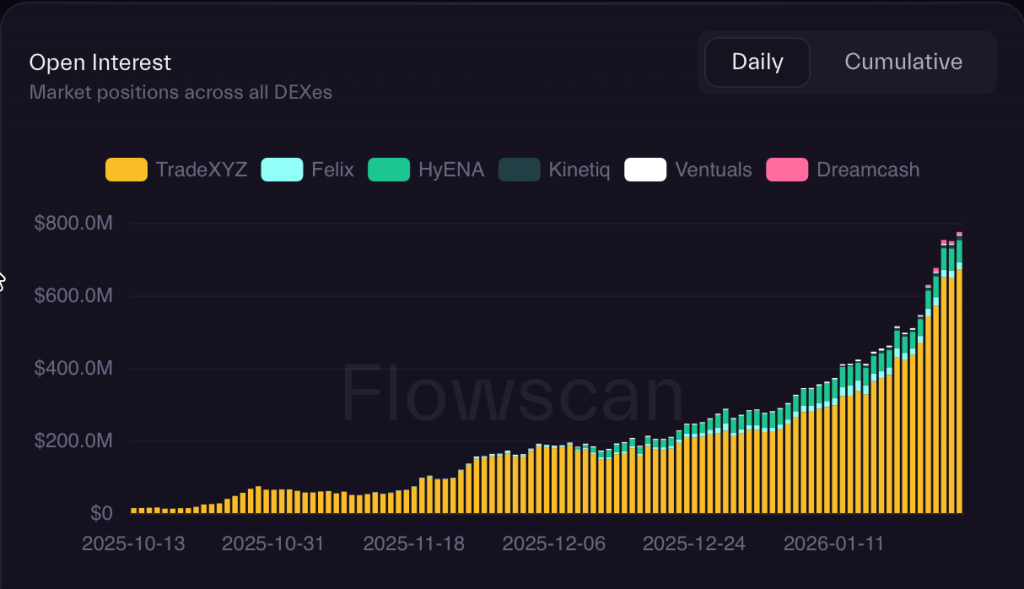

Hyperliquid HIP-3 Open Interest Smashes ATH

The popular layer-1 chain, Hyperliquid, witnessed a huge rise in volume since the past trading day, mainly due to the explosion in trading through “Builder-Deployed Perpetuals.” The levels rose magnificently, which marked an ATH of $790 million. In a post, Hyperliquid attributed the rapid adoption of HIP-3 as a major reason behind the surge.

HIP-3 or Hyperliquid Improvement Proposal, which went live last October, enables the builders to launch perpetual futures contracts for any asset with a price feed. The upswing indicates the rally being driven more by aggressive positioning in perpetual markets than spot accumulation. This suggests new positions are entering, while HIP-3 growth confirms platform-specific demand, not just broader market data.

Hyperliquid (HYPE) Price Analysis—Can Buyers Sustain the Current Momentum?

On the daily timeframe, Hyperliquid (HYPE) shows early signs of trend stabilization after an extended corrective phase. Price action has rebounded sharply from the lower demand region near $21, supported by rising volume and stronger bullish candles. This recovery has brought HYPE back toward a key mid-range resistance zone, where previous breakdowns occurred. The structure suggests buyers are attempting to regain control, though confirmation depends on acceptance above nearby supply levels and follow-through momentum.

On the daily chart, Hyperliquid (HYPE) is attempting a structural recovery after rebounding from the $21–$22 demand zone. Price has pushed back toward the $27–$28 supply area, while the Supertrend remains bearish, indicating the broader trend has not fully flipped yet. Meanwhile, the DMI has printed a bullish crossover, with +DI overtaking −DI, signaling improving directional momentum. This combination suggests an early trend transition, but confirmation requires a Supertrend flip and acceptance above resistance.

Will Hyperliquid Price Reach $50 in February?

From a technical standpoint, Hyperliquid (HYPE) would need multiple confirmations to justify a move toward $50. Price is still trading below key overhead resistance zones near $28 and $34–$36, while the Supertrend remains bearish, signaling that the broader trend has not yet flipped. Although the bullish DMI crossover supports short-term momentum, sustained upside would require acceptance above these levels and continued volume expansion. Unless structure improves decisively, a $50 move in February appears ambitious rather than probable, with consolidation or gradual continuation being more realistic.