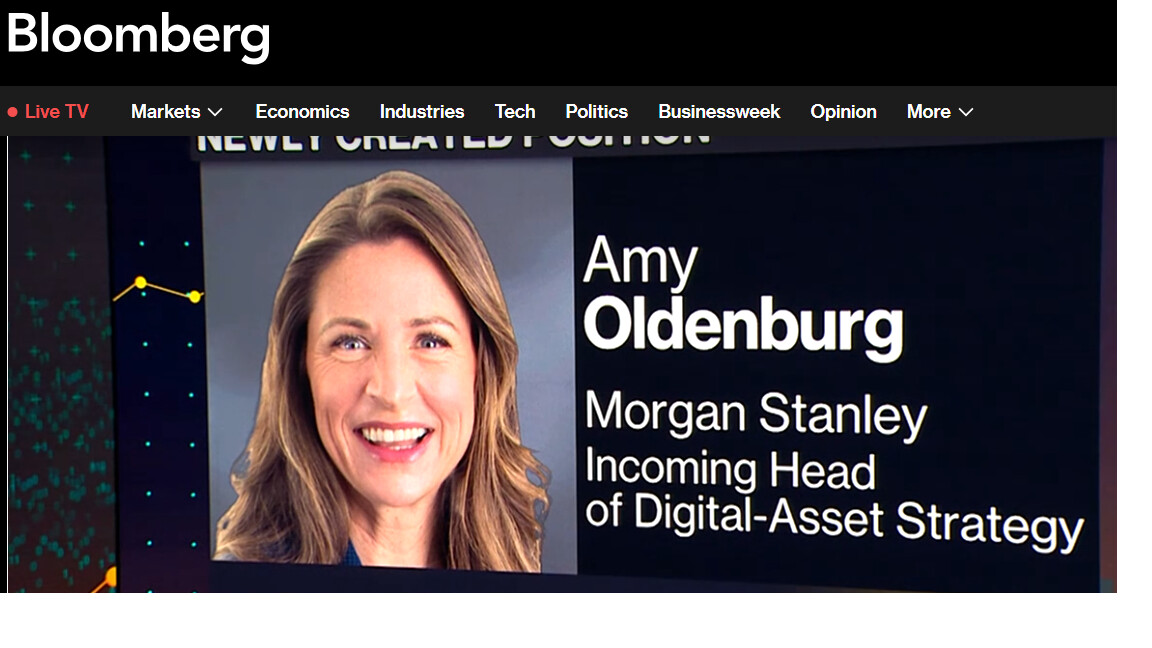

Morgan Stanley Names Digital-Asset Strategy Chief as Crypto ETFs and Wallet Plans Accelerate

Key Takeaways:

- Morgan Stanley named longtime executive Amy Oldenburg its head of digital-asset strategy.

- The position formalizes the push of the bank into the crypto product, such as spot ETFs and a digital wallet..

- The move implies the transition between cautious integration to organized crypto on a large-scale basis.

Morgan Stanley is sharpening its crypto strategy. The bank has created a new role – head of digital-asset strategy and tapped longtime executive Amy Oldenburg to lead it, marking a clear step deeper into digital assets.

The appointment comes as large U.S. banks move from experimentation toward full product rollouts tied to crypto mar.

Morgan Stanley Formalizes Its Crypto Leadership

Amy Oldenburg moves to the newly established position after working at Morgan Stanley for more than two decades. Previously, she led the bank’s new emerging market equity market business in which she participated in internal initiatives relating to digital assets.

By creating an independent digital assets strategic position, Morgan Stanley is signaling clearly that crypto is no longer an adjacent topic. It is becoming a part of the bank’s core product development plan across asset management, trading and market access.

The timing matters. In the recent past, Morgan Stanley applied to numerous crypto exchange-traded funds, such as spot Bitcoin and Solana products, and as of next, staked ETF. These submissions formed the most apparent move by the bank into regulated crypto investment vehicles since it largely avoided the initial institutional adoption surge.

Read More: Morgan Stanley Files First-Ever Bitcoin and Solana ETFs, Opening Wall Street’s Gates to Crypto

Oldenburg’s View on Custody and Control

Oldenburg has publicly stated the significance of self-custody and direct ownership of assets and especially that of the users in emerging markets. She has also been a participant in the previous debates over the extent of early crypto ETFs and, in particular, those products lacking staking or yield generation.

That standpoint can influence the positioning of the offerings of Morgan Stanley. The bank seems to be considering the designs of exposing, utilizing, and complying with the current brokerage frameworks rather than investing in crypto as an asset that tracks prices.

Read More: JPMorgan Eyes Bitcoin & Ethereum Loans as Crypto Lending Market Hits $39B Milestone

The post Morgan Stanley Names Digital-Asset Strategy Chief as Crypto ETFs and Wallet Plans Accelerate appeared first on CryptoNinjas.