Avalanche RWA TVL Jumps 69% to $1.33B in Q4 as BlackRock, ETFs Fuel Onchain Surge

Key Takeaways:

- BlackRock tokenized $500 million on Avalanche and until the end the last quarter 2025, the total tokenized Real World Asset (RWA TVL) on this has reached up to $1.33 billion

- Bitwise and VanEck ETF filings also included staking, which suggest more institutional crypto vibes

- But the usage of the network hit an all-time high when AVAX price fell nearly 60% that quarter

Avalanche closed Q4/2025 with strong participation level from organizations and all-time onchain activities. The fund flow has been moved into tokenized assets, ETF and enterprise platforms, regardless of the AVAX’s significant decrease pressure.

Read More: First-Ever AVAX ETF Hits Nasdaq as VanEck Waives Fees on $500M for Avalanche Exposure

BlackRock and Institutions Push RWA Growth on Avalanche

Tokenized real-world assets became Avalanche’s fastest-growing segment in late 2025. RWA total value locked rose 68.6% quarter over quarter and nearly 950% year over year, ending December at $1.33 billion.

The main driver was BlackRock’s launch of its USD Institutional Digital Liquidity Fund (BUIDL) on Avalanche. The firm tokenized $500 million in assets, giving the network one of the largest onchain money market funds in production.

Other institutions followed. Fortune 500 fintech FIS partnered with Intain to bring tokenized loan markets to Avalanche, allowing roughly 2,000 U.S. banks to buy, sell, and securitize billions of dollars in loans with near-instant settlement. Another entry point was made by S&P Dow Jones who joined forces with Dinari to introduce the S&P Digital Markets 50 Index, a tokenized instrument, combining crypto-linked equities and crypto-assets.

Activity was not limited to the U.S. In Japan, Progmat migrated more than $1.1 billion in tokenized securities to a dedicated Avalanche L1, while payment giant TIS Inc. launched a multi-token banking platform via AvaCloud.

Read More: Avalanche Foundation Eyes $1B Institutional Capital via US Corporate Treasuries

ETF Filings Add Staking as AVAX Price Slides

The institutional interest leaked into regulated investment products. Bitwise and VanEck revised their Avalanche ETF filings but added staking to it. Bitwise’s proposed BAVA trust plans to stake up to 70% of its holdings, allowing investors to earn native yield rather than rely only on price appreciation.

Network Activity Decouples From Token Price

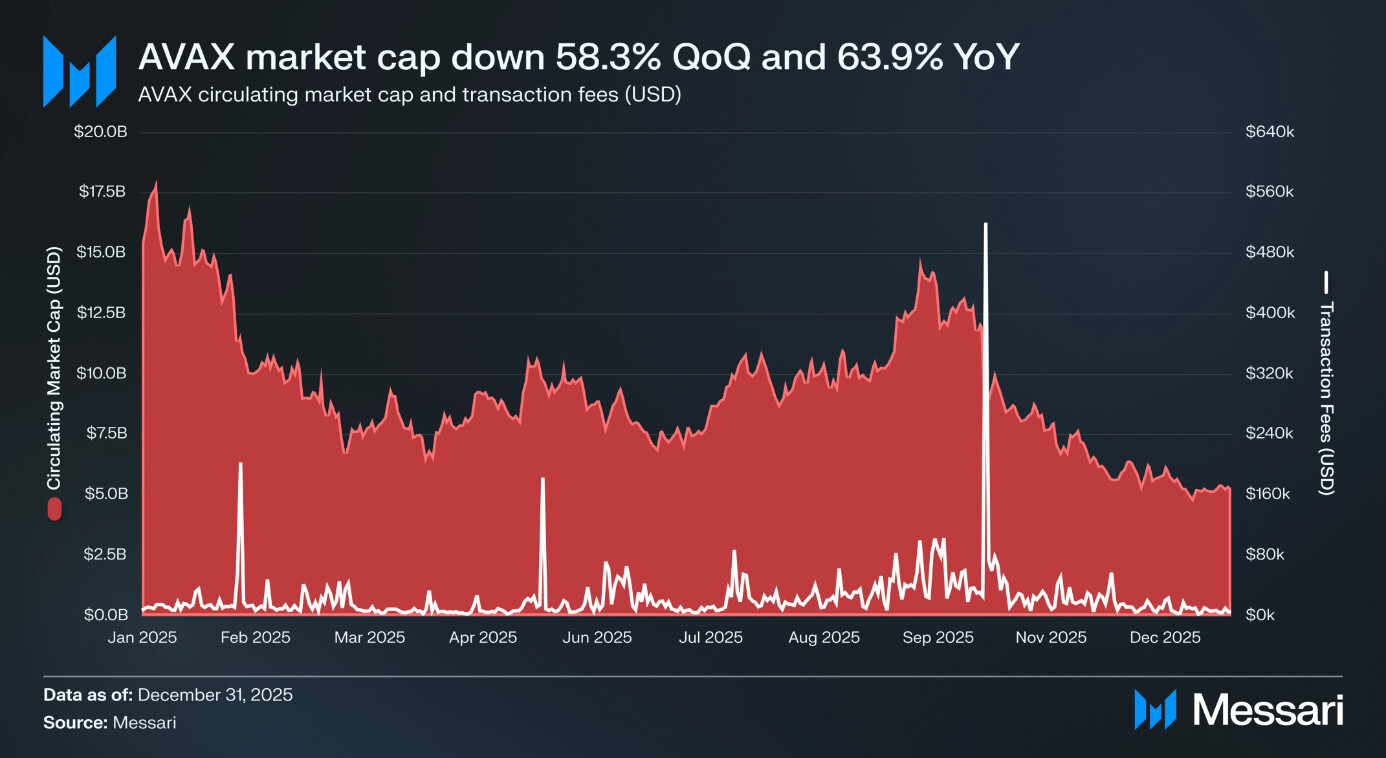

AVAX ended the quarter at $12.3, having fallen 59% on the fourth quarter, and over 65% compared to the same quarter a year ago. Market cap rankings decreased, relocating AVAX to the 21st position out of the 14th rank.

Still, network usage shot up. The number of fees paid in AVAX more or less increased by nearly 25% points quarter-to-quarter, and average daily C-Chain transactions increased by 63% to 2.1 million. Volatility on the October crash generated the largest single-day fee revenue since the first months of 2024.

DeFi Liquidity Stays Sticky as Usage Hits Records

DeFi liquidity remains seductive as it is used to record record numbers. Avalanche DeFi ecosystem continues to be very robust, with TVL in terms of AVAX more than 34% in Q4 indicating that users were holding assets and non-native currencies on-chain rather than transferring liquidity to other locations.

Activity at the network level was taken to new heights. Daily C-Chain and Avalanche L1s transactions increased to 38.2 million and daily active accounts reached almost 25 million. This rise was in part due to the adoption of Avalanche L1 in Asia where ten to tens of millions of users were onboarded on telecom networks onboard.

The post Avalanche RWA TVL Jumps 69% to $1.33B in Q4 as BlackRock, ETFs Fuel Onchain Surge appeared first on CryptoNinjas.