Serious $50K Bitcoin Warning Rattles Market as Crash Fears Grow

Clearly, it is a rough day on the charts. Bitcoin, Ethereum, and most of the top 10 assets are in the red, extending losses from the end of 2025. Whether this state of affairs will continue remains to be seen.

What’s evident, however, is that the Bitcoin price is dropping so fast and by so much that gains from late 2024 have been completely reversed. There are now concerns that the BTC USD price could sink below today’s lows toward $50,000, a key psychological support level.

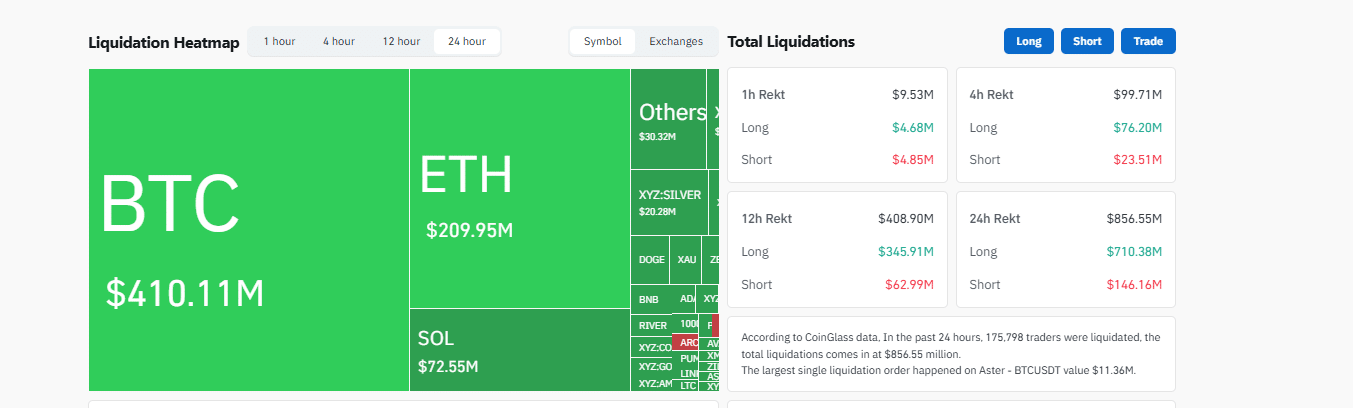

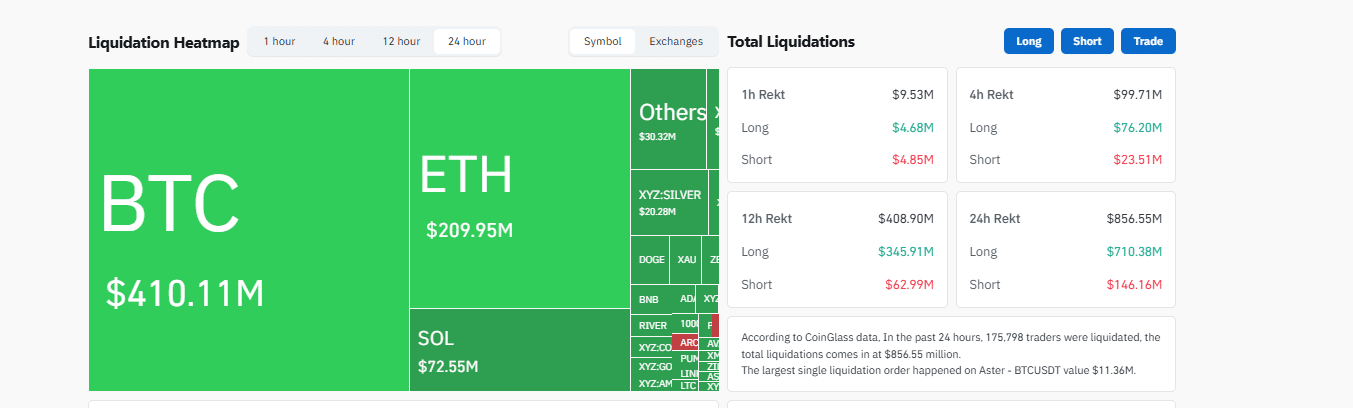

This possibility alone would be a massive blow to the industry, likely wiping out tens of billions of dollars worth of leveraged bets. Thus far, as the Bitcoin price tanked towards the $70,000 level, over $850M in leveraged trades were liquidated on multiple exchanges, mostly Binance, Bybit, and Hyperliquid.

(Source: Coinglass)

These liquidations affected more than 175,000 traders across these platforms. A big chunk of these liquidations was Bitcoin and Ethereum longs.

DISCOVER: Top 20 Crypto to Buy in 2026

Bitcoin Price to $50,000? Binance Founder To Blame?

The current sell-off comes during a tense stretch where investors already feel jumpy about a broader market correction. Notably, the spark came from an unexpected shift in tone from Binance founder Changpeng “CZ” Zhao, who said he no longer trusts the idea of a smooth 2026 Bitcoin “super cycle.”

During an “Ask Me Anything” (AMA) session late last month, CZ said he was “a bit less confident” about the idea of a smooth, uninterrupted super cycle. Specifically, he observed that while he believes the Bitcoin price and some of the best cryptos will edge higher in the long term, the ride is no longer guaranteed to be “smooth.”

Lmfao

CZ said he’s now “less confident” in the Bitcoin super cycle because people are fudding him

You genuinely can’t make this up pic.twitter.com/Xpkp0WtZ5v

— zubic (@zubic_eth) February 1, 2026

His comment is a shift from what he said earlier in Davos at the World Economic Forum. Then, the Binance founder said he had “very strong feelings” that 2026 would be a Bitcoin supercycle. Behind his optimism was the support for crypto not just by the US but by more countries across the globe. Given this adoption, the Binance founder said BTC USDT might break its traditional four-year halving cycle and just keep moving upward.

CZ about the bitcoin super cycle yersterday pic.twitter.com/Moj8Xn0cHe

— Ram

(@RamadoneA) January 31, 2026

However, by shifting his position on Bitcoin and crypto in general, CZ is causing jitters in the market. When the most recognized exchange founder sounds unsure, beginners feel it fast. That fear matters because crypto runs on confidence. When belief cracks, selling speeds up. Given this, his comments might be another reason for Wall Street and institutions to exit, take profit, and heap more pressure on Bitcoin prices, perhaps even down to the $50,000 mark.

DISCOVER: 9+ Best Memecoin to Buy in 2026

What’s Going On? Why is Crypto Down?

The $50,000 level is not magic but more like a psychological floor that traders are watching, especially if $70,000 is broken. It is not an impossibility. Earlier, Michael Burry, known for calling the 2008 housing crash, warned that Bitcoin lacks a clear use case to stop falling right now.

His concern cuts deeper: if Bitcoin falls to $50,000, some mining firms may not cover costs. Miners keep Bitcoin running; they verify transactions and earn new coins. If too many miners fail, the network stays alive, but fear spikes. So far, miners appear to be switching off their rigs, explaining the drop in hash rate. As they power off their rigs, they might also liquidate BTC. When miners sell, prices tend to tick down even faster.

No one is talking about Bitcoin's hash rate collapsing -40% from ATH. The biggest miner capitulation since 2021. Yikes. Energy value falling in turn. Very certainly means some big miners are pivoting out of crypto. pic.twitter.com/JKFQmQeHYl

— Charles Edwards (@caprioleio) January 29, 2026

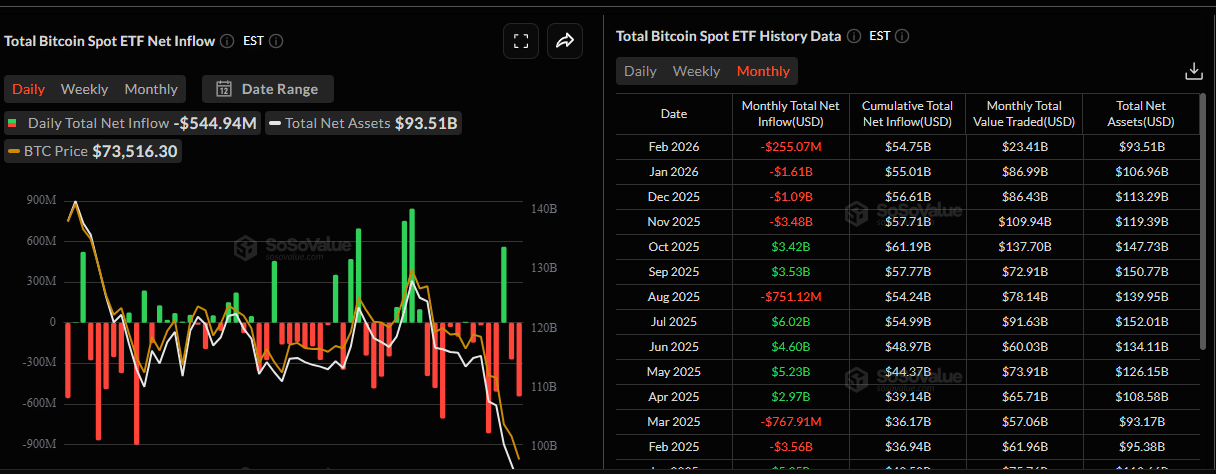

The situation is further worsened by institutions. The narrative that “the ETFs will save us” has hit a major speed bump. After billions poured in last year, the tide has turned. In January 2026 alone, spot Bitcoin ETFs saw over $1.6Bn in net outflows. Traditional investors are pulling back as the “debasement hedge” narrative, buying BTC to protect against a falling dollar, has weakened.

(Source: SosoValue)

Until there is a shift and the cascade of leveraged bets stops being liquidated on Binance and other perpetual exchanges, the Bitcoin price will likely remain weak.

On X, one analyst notes that since the BTC USD price has broken below $80,000, the next feasible support is $65,000.

Bitcoin cannot lose $81K under any circumstances, according to on-chain analysis.

If this level breaks, a capitulation process similar to 2022 may unfold.

The next major support would sit around $65,500.

Hard to believe for many — but this same disbelief about how far price… pic.twitter.com/IcGLelt2pP

— Joao Wedson (@joao_wedson) January 27, 2026

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Serious $50K Bitcoin Warning Rattles Market as Crash Fears Grow appeared first on 99Bitcoins.