Tom Lee Defends BitMine’s $6B ETH Loss

These are hard times for crypto holders as Bitcoin keeps falling again and again, now hitting a new yearly low at $70,500. Ethereum is also following the same path, briefly trading below $2,100. A company that went full ETH maxi is now watching losses pile up. Tom Lee’s ETH exposure hit BitMine stock, with BMNR sliding alongside ETH and leaving about $6 billion in paper losses.

Remember Tom lee?

he bought ETH at 4k, now he’s down $6,700,000,000 (-43.04%) on $ETH holdings. pic.twitter.com/RWcLi4JiTO

— hødl (@hodl_strong) February 2, 2026

By late 2024, the company transitioned from a traditional mining firm into an “ETH treasury” strategy, adopting a philosophy they call the “Alchemy of 5%.” Their goal is to eventually own 5% of the total Ethereum supply.

BitMine is not the only company to take this path. After spot Ethereum ETFs won approval in 2024, large institutions poured more than $10 billion into regulated ETH products. Now, those same companies are facing real pressure as prices continue to plummet, especially after Treasury Secretary Scott Bessent made it clear that banks will not bail out crypto-linked firms.

EXPLORE: Best New Cryptocurrencies to Invest in 2026

Tom Lee: The ETH Conviction Still Holds Despite $6B in Unrealised Loss

BitMine has accumulated approximately 4.28 million ETH (roughly 3.55% of the total supply). However, this aggressive accumulation came at a high cost:

- Average Buy Price: Estimated between $3,600 and $3,883 per ETH.

- Total Investment: Approximately $15.65 billion.

- Unrealized Losses: With ETH recently sliding toward $2,100, the company is sitting on roughly $6 billion to $7 billion in “paper” losses.

Tom Lee argues these ETH losses are “on paper,” not locked in. Once Ethereum’s price recovers, this crisis will quickly be forgotten. History has proven him right so far. Companies like Strategy, holding Bitcoin, faced criticism during the bear market but later gained admiration as Bitcoin reached a $126k all-time high in late 2025.

Will history once again redeem both Tom Lee and Michael Saylor?

Despite these staggering figures, BitMine isn’t just “holding.” They have staked over 2.9 million ETH, generating an estimated $188 million in annual staking revenue. They are also launching the MAVAN (Made-in-America Validator Network) to provide staking infrastructure for other institutions.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

This Is “A Systematic Liquidation Cycle”

Tom Lee remains the strategy’s most vocal defender. He views the current price drop not as a failure of the asset, but as a necessary market “pruning.” His points are:

- On-Chain Growth: Lee points out that while the price is down, Ethereum’s fundamentals are at all-time highs. Specifically, daily transactions hit 2.5 million, and active addresses reached 1 million.

- The $2,500 “Floor”: Lee previously predicted a Q1 2026 drawdown to the $2,500 (and potentially $1,800) range before a massive year-end rally. He maintains that the current pain is a “paper” crisis that will evaporate once the “super cycle” resumes.

- Institutional Rails: He argues that Ethereum is becoming the settlement layer for global finance, citing the $18 trillion in USDC transactions processed on the network in 2025.

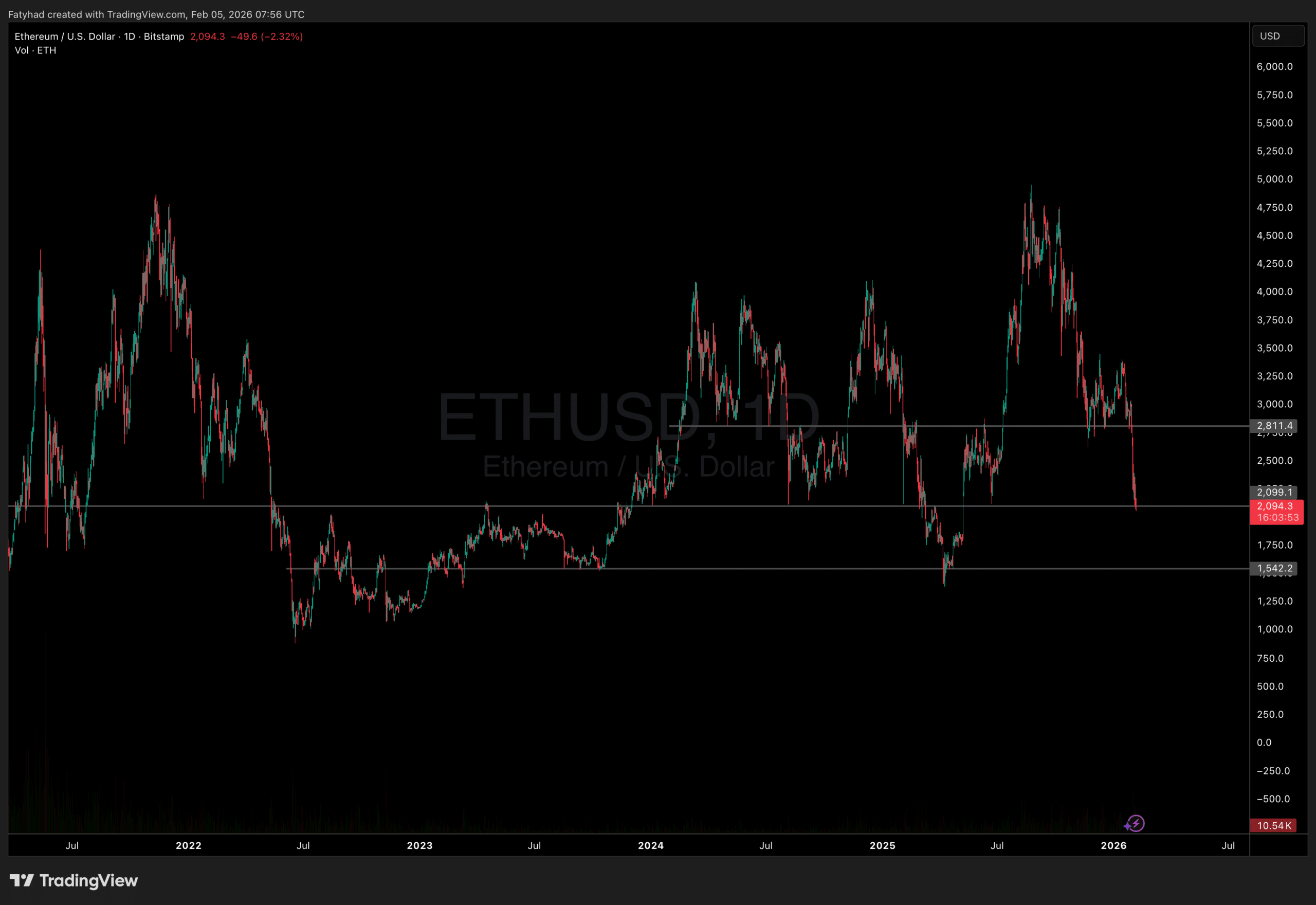

(Source: TradingView)

Ethereum is trading just below its support at around $2,100. It has fallen 7–8% in the last 24 hours and 25–30% over the past week. The oversold RSI suggests potential short-term relief but no reversal yet.

For now, sentiment remains weak. A break below $2,000 could push ETH towards $1,750, while a bearish thesis predicts $1,550 as a possible next level.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Tom Lee Defends BitMine’s $6B ETH Loss appeared first on 99Bitcoins.