Virginia Advances Bill For State Bitcoin Fund Strengthening $HYPER Market Position

What to Know:

- Virginia’s legislative advance toward a state Bitcoin fund validates the asset class and increases the need for scalable Bitcoin infrastructure.

- Bitcoin Hyper ($HYPER) leverages the Solana Virtual Machine (SVM) to bring high-speed smart contracts and DeFi utility to the Bitcoin ecosystem.

- Institutional interest is reflected in on-chain data, with over $31.2 million raised in presale so far.

The race for state-level crypto adoption just shifted gears. Virginia lawmakers are advancing legislation to establish a dedicated state Bitcoin fund, moving from mere regulatory curiosity to strategic accumulation. The legislation would set up the Commonwealth Strategic Cryptocurrency Reserve Fund. Currently winding through committee, the bill aims to diversify the Commonwealth’s reserves and use digital assets as a hedge against fiat debasement.

The legislation would enable Virginia to invest state-held funds directly into $BTC or other qualifying crypto. This could create a reserve that modernizes treasury management and puts the state in a good position, ready for the future of digital finance.

Headlines focus on the asset class, but the real story is infrastructure. If states start hoarding Bitcoin, the demand for yield-bearing utility on the network will likely explode. Bitcoin in cold storage is a passive vault; Bitcoin on a high-performance Layer 2 is active capital.

That distinction drives capital toward infrastructure plays, unlocking Bitcoin’s liquidity. The narrative isn’t just about holding $BTC anymore; it’s about using it. As institutional interest crystallizes around state-backed adoption, liquidity flows toward solutions fixing Bitcoin’s scalability issues.

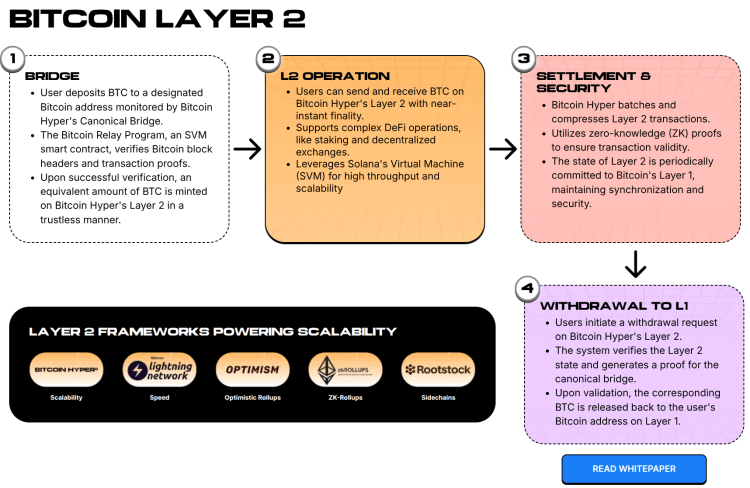

Bitcoin Hyper ($HYPER) is positioning itself to capture this ‘utility rotation.’ By fusing the Solana Virtual Machine (SVM) with Bitcoin’s security architecture, the project acts as the execution layer for this incoming wave of institutional adoption.

The SVM Advantage: Why Bitcoin Hyper Is The Logical Hedge

The Virginia bill is a massive catalyst, but a technical bottleneck remains: Bitcoin’s base layer manages roughly 7 transactions per second (TPS). That’s too slow. State funds and managers need high-frequency execution for rebalancing, something the main chain just can’t support.

Bitcoin Hyper ($HYPER) tackles this by introducing the first-ever Bitcoin Layer 2 powered by the Solana Virtual Machine. It’s not a subtle upgrade. It swaps Bitcoin’s sluggish speeds for low-latency execution while keeping L1 security for final settlement. For developers, this unlocks a Rust-based environment where dApps run at Solana speeds (but settle on Bitcoin).

Liquidity follows the path of least resistance. Current ‘wrapped’ Bitcoin solutions often rely on clunky centralized bridges or slow sidechains. In contrast, Bitcoin Hyper uses a decentralized Canonical Bridge, offering a trust-minimized path for $BTC transfers. By enabling high-speed payments and complex DeFi protocols (swaps, lending, staking), the protocol turns passive state reserves into productive assets.

The market’s appetite for this modular architecture, L1 settlement plus SVM L2 execution, is clearly growing. As Virginia moves to legitimize Bitcoin holdings, the premium on ‘programmable Bitcoin’ expands. Frankly, the ability to offer smart contract support where none existed before makes this a critical piece of infrastructure for the post-adoption era.

FIND OUT MORE ABOUT BITCOIN HYPER

Whale Accumulation Signals Smart Money Positioning

While lawmakers debate policy, on-chain metrics suggest smart money is already front-running the trade. The gap between retail uncertainty and whale is wide.

Bitcoin Hyper has raised over $31M, a figure signaling serious confidence despite broader volatility. At $0.0136752, the entry point appears to be attracting high-net-worth volume.

Whales are moving. With accumulations totalling $500K and $379.9K they scream conviction in the project’s long-term value.

Beyond capital inflows, the tokenomics encourage patience. Staking opens immediately after the Token Generation Event (TGE) with high APY rewards. Plus, presale stakers face a 7-day vesting period, a mechanism likely designed to dampen post-launch volatility and reward true believers.

With a trusted sequencer ensuring rapid state anchoring to Bitcoin L1, technical risk is minimized while throughput stays high. For investors watching Virginia, $HYPER represents a leveraged bet on the infrastructure needed to support state-level adoption.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry inherent risks, and readers should conduct their own due diligence before making any investment decisions.