The Only 3 Top Cryptos You Need to Own for a Perfect 2026

The post The Only 3 Top Cryptos You Need to Own for a Perfect 2026 appeared first on Coinpedia Fintech News

As institutional giants pour billions into the crypto market, 2026 no longer rewards speculation alone. Dogecoin hovers near $0.09, pinned below resistance, while Solana trades 68% off its peak despite network growth hitting 118 million active addresses. Against this backdrop, capital is rotating toward projects with live infrastructure and direct profit mechanisms.

Mutuum Finance (MUTM) has secured $20.5 million from 19,000+ holders, delivering what DOGE and SOL currently cannot: a testable protocol, passive yield, and tokenomics designed for holder upside. A position secured today mathematically positions the investor for asymmetric returns.

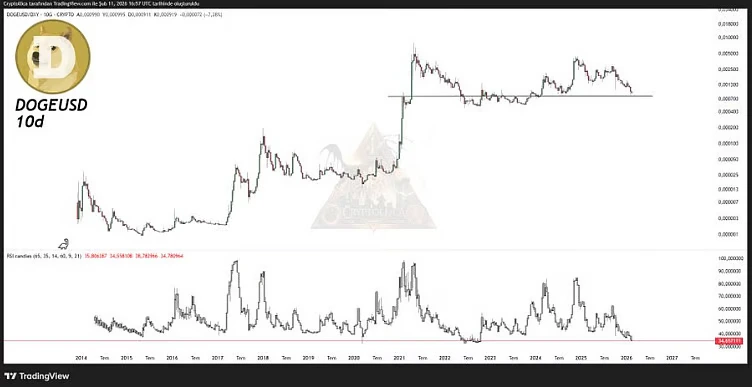

Dogecoin: Meme Gravity Persists

Dogecoin continues trading near $0.094 after failing to hold the $0.10 handle. Analyst charts flag a DOGE/DXY ratio sitting at historic launchpad levels, yet price remains captive to declining channel resistance at $0.0935. The 10-day RSI lingers near 34, mirroring stress periods from 2015 and 2022, but the structure lacks protocol-level revenue or buyback flows.

With sellers outpacing buyers 55% to 45%, DOGE relies entirely on retail narrative recurrence. No yield accrues, no fees are distributed, and no deflationary pressure exists. For the investor seeking compound mechanics, the asset remains static and not the next crypto to explode.

Solana: Adoption Without Price Flow

Solana processes 2.7 billion transactions and hosts $1.64 billion in tokenized real-world assets. BlackRock, Apollo, and now Citigroup build on the network. Yet SOL trades at $78, down from $250, while the head-and-shoulders pattern targets $50.

The disconnection between usage and token performance illustrates a structural gap: network fees do not accrue to SOL holders in a direct buyback and distribution format. Transaction volume surged 55%, but the token remains on a downtrend. Institutional usage grows, yet the token lacks a dividend-style feedback loop. Adoption alone does not guarantee price appreciation, and thus, Solana is no longer the top crypto to buy.

Mutuum Finance (MUTM) Testnet Now Live

Mutuum Finance eliminates the disconnect between usage and holder profit. The protocol, already live on Sepolia testnet, supports lending and borrowing across testnet tokens USDT, ETH, LINK, and WBTC. The protocol is not live yet; users are only testing the protocol without putting their assets on the line.

The Mutuum Finance Ecosystem

Mutuum Finance offers lending and borrowing at attractive rates. For instance, a lender depositing $12,000 in USDC could earn an 11% APY, generating $1,320 in passive income in just one year. Borrowers, on the other hand, get overcollateralized loans. For example, $12,000 collateral at a 75% Loan-to-Value ratio gets the borrower a $9,000 loan.

Moreover, the protocol’s buy-and-distribute mechanism channels a fraction of protocol revenue directly to stakers. Assuming $2.8 million in fees, 20% could be directed to these rewards, distributing $140 per $1,000 staked. Unlike DOGE or SOL, which lack any such revenue link, Mutuum Finance converts platform usage into direct tokenholder dividends, making MUTM the next crypto to explode.

Presale: The Asymmetric Window

Mutuum Finance’s presale phase 7 sells at $0.04, a 300% gain from Phase 1’s $0.01. With 850 million tokens already absorbed and only 45% of the total supply allocated to presale, available inventory diminishes rapidly. A $1,150 purchase today acquires 28,750 MUTM. At the $0.06 launch price, that position becomes $1,725, a $575 gain before immediately rising as adoption spikes.

Analysts tracking live testnet metrics, Halborn-audited contracts, and multi-chain roadmap note that post-launch demand from non-presale buyers could drive price toward $1.80. Under that scenario, the same $1,150 scales to $51,750. Phase 8 opens at $0.045, a near 20% increase, which means that the current phase represents the final sub-$0.045 access.

Fixed Supply, Expanding Demand

MUTM caps total supply at 4 billion tokens, and no additional minting will occur. With 45.5% to be sold during presale and 5% allocated to community incentives and giveaways, the circulating supply locks into holder wallets early. This contrasts sharply with inflationary models diluting long-term participants.

For the investor seeking what crypto to buy now, the difference between MUTM and legacy assets such as Digecoin and Solana is execution: a working product, transparent dividend flows, and a presale discount closing within days.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance