ETH Price Analysis: Bullish Run Continues for the 3rd Day in a Row

As the Altcoin market takes a breather, whales began accumulating ETH confirming interest at current prices above $2,400.

*ETH breaks into new high near $2,500 psychological zone

*Markets expect Ethereum (ETH) price to have skyrocketed to $3000 in April

*Ethereum rallies to new ATH amid Berlin Upgrade

ETH bulls are making a full comeback as receding Bitcoin (BTC) price make Altcoins attractive again. A close above the prior day high at $2,400 suggests that buyers have fully returned. Buyers are increasing their positive bias after several days of a flat period within the $2,150 zone as the bullish run continues for the 3rd day in a row without a breather.

Markets expect Ethereum (ETH) price to have skyrocketed to $3,000 in April. Consensus for the upside target lies initially at $2,500 and even higher at $3,000 for the core target (depending on the volume). Several elements justify a steady bullish run, going from a rebound after a corrective bearish-impacted early April. After hitting the milestone near the $2,500 psychological zone, the market may take a moment to digest the new record high.

Ethereum Rallies to New ATH Amid Berlin Upgrade

Ethereum (ETH) hit an all-time high of $2,486.50 on April 14. The technical indicators are bullish and the RSI has just crossed the 73 marks. Berlin is a proposed upgrade to the Ethereum 1.0 chain after the Muir Glacier. According to the specification, it is expected to be activated on the Ropsten Testnet at block # 9_812_189 and the mainnet on April 15, 2021, at block # 12_244_000.

The following changes to Ethereum are included in the Berlin upgrade: EIP-2565: ModExp Gas Cost, EIP-2929: Gas cost increases for state access opcodes, EIP-2718: Typed Transaction Envelope, EIP-2930: Optional access lists. You can use Ethernode’s Berlin status page to see how far the Berlin update has progressed.

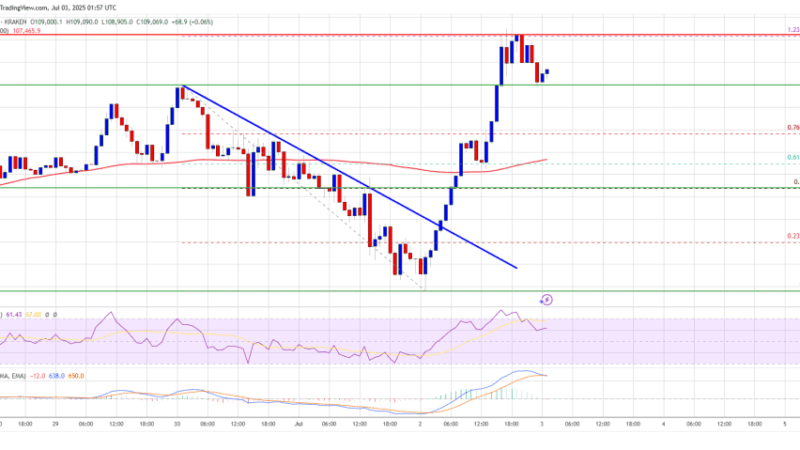

ETH Daily Chart: Bullish

ETH hit a high of $2,486 on April 15 before falling to intraday lows of $2,401. The bulls’ repeated attempts to transform the $2,500 resistance line into support since April 14 demonstrate their hesitancy at this price level. The bulls will then try once more to push the price of ETH beyond $2,500. If they succeed, the ETH/USD pair could rally to $2,650, which is the next goal.

If selling pressure resumes, however, the focus may shift to the $2,317-$2,200 support range. The $2,145 April 2 strong, as well as the MA 50 support at $1,845 and the ascending trendline support at $1,800, could be seen first underneath this level. Since ETH is not overbought, the RSI reading is slightly above 70, indicating a potential upside rally towards the $3,000 mark.

ETH 4-Hour Chart: Bullish

The price of ETH has fallen after reaching a recent high of $2,486 but remains above the negative zone. At $2,405 a low was established, and the price later recovered to $2,440 on April 15. On the downside, the MA 50 support level of $2,175 is a key support level for sellers, as Ethereum is currently reliant on it to hold in the event of a sharp drop.

There is a chance of a downside break below the $2,150 level ahead of the $2,100 support if the sellers succeed in clearing the MA 50. If the price of ETH/USD continues to fall, it may find support at the next buyer congestion zone of $2,041. If the price breaks above the immediate barrier at $2,500, it may try to reach the $2,650 level or even higher.

Key Levels

Resistance Levels: $3,000, $2,650, $2,500

Support Levels: $2,300, $2,200, $2,100

Image Credit: Tradingview

Note: coinpedia.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event