Decentralized-to-centralized exchange trade volume ratio sets new all-time high at 22%

Data shows that the decentralized exchange (DEX) to centralized exchange (CEX) trading volume ratio is up.

Commenting on the trend, the founder of Your Crypto Community Duo Nine, stated, “DEXs are eating CEXs market share.” He attributed this to “more regulation,” which meant “DEXs are exploding.”

Signing off, he wrote, “The future is decentralized.”

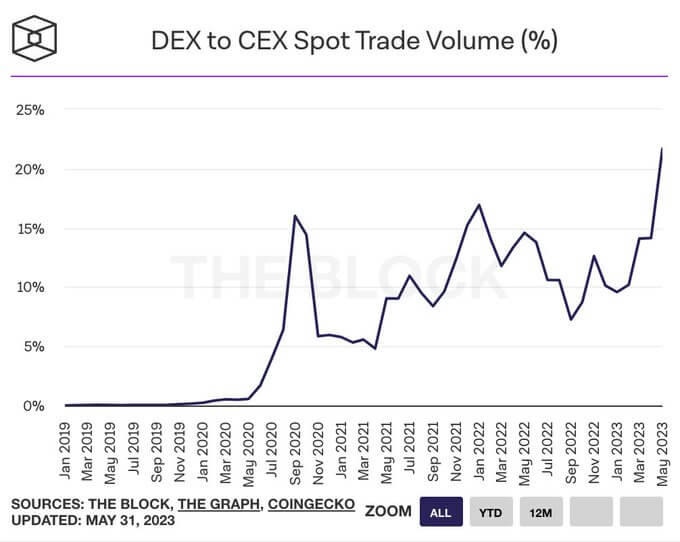

The chart below shows the DEX to CEX trade volume ratio since January 2019. The ratio began moving higher around May 2020, as the market moved into “DeFi summer,” which was the period when DeFi applications supporting yield farming, lending, and borrowing, first took off, to peak at 16% by September 2020.

The ratio reached a new top by January 2022 of approximately 17%. Likely due to participants realizing the market top was in, a general downturn followed, causing the ratio to fall and bottom at 8% by September 2022.

Since then, the ratio has been climbing, with a sharp acceleration in April 2023 pushing it past the previous peak to its current level of 22%.

Crypto sentiment

On June 1, CryptoSlate reported a significant decrease in daily CEX trade volume to levels last observed in late 2020, suggesting market apathy.

Analysis of the Total Value Locked (TVL) in DeFi protocols for comparison showed a minor uptick to peak at $53 billion on April 16. Nonetheless, the TVL chart depicted a relatively flat pattern since the start of the year.

The rising DEX to CEX trade volume ratio is supported by falling CEX activity and flat TVL in DeFi protocols. However, rather than a flight to DEXs, and a flood of new DEX users, the flat TVL pattern indicates DEX users are holding their own amid market uncertainty.

The post Decentralized-to-centralized exchange trade volume ratio sets new all-time high at 22% appeared first on CryptoSlate.